The Statement Difference

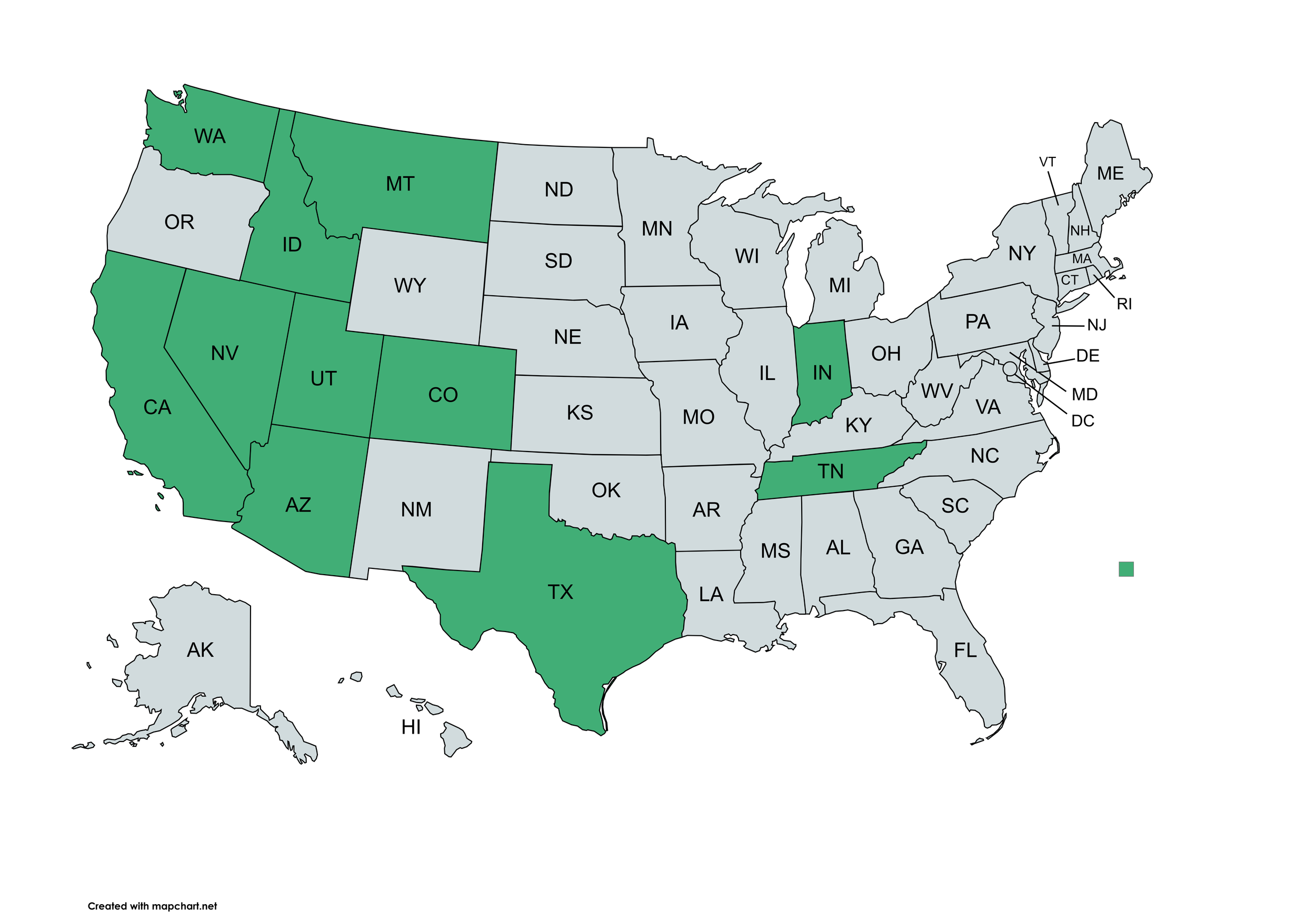

Statement Insurance Agency is a locally owned, independent insurance agency based in Reno, Nevada built to make insurance simple, reliable, and cost-effective for the businesses we serve. Because we’re not tied to a large corporation or private equity group, our advice stays exactly where it should be: with you. That independence means straightforward guidance, responsive service, and coverage designed around your real-world risks and not a corporate playbook. We’re proud to protect companies across Nevada and throughout the West, while reinvesting in the community we call home—delivering insurance with no surprises, no regrets, and a team you can actually reach when it matters.

Our Team

“VOTED BEST LOOKING AGENCY IN NORTH AMERICA”

Mark Hutchings - Principal & Founder

With over 16 years in the industry, Mark leads the agency with a hands-on approach, specializing in mid-market risk solutions across our core industries. He’s the architect behind Statement’s straightforward, client-first approach.

Kyle Robertson- Account Executive

Focused on business development, Kyle helps new clients find the right fit. He’s deeply knowledgeable about industry-specific risks and is committed to helping clients feel confident in their coverage.

Madi Milke - Account Manager

Madi oversees client service and renewals, bringing a sharp eye for detail and a passion for making coverage easy to manage. She’s your go-to for clear answers and proactive support.

Gwen Ballesteros- Associate Account Manager

Gwen supports our account management efforts and helps ensure everything runs smoothly behind the scenes. He’s efficient, responsive, and focused on making service seamless.

Our partners